what tax form does instacart use

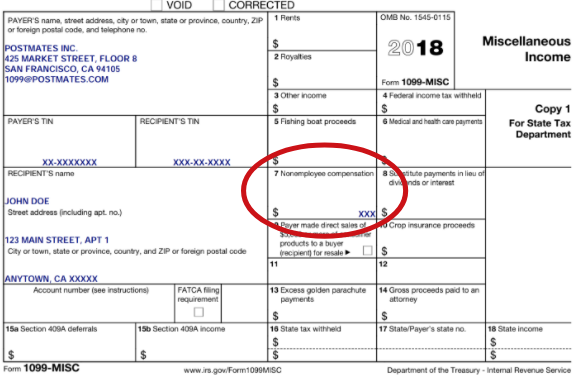

Instacart Tax Forms. If you earned at least 600 delivery groceries over the course of the year including base pay.

What You Need To Know About Instacart Taxes Net Pay Advance

If you work with instacart as a shopper in the us visit our stripe express support site to learn more about 1099s and how to review your tax information and download your tax.

. Youll need your 1099 tax form to file your taxes. You wont send this form in with your tax return but. Instacart uses a platform called Stripe Express which allows you to view your earnings review your tax information and download tax forms including 1099 Instacart tax forms.

How do I update my. Register your Instacart payment card. For Instacart workers Instacart taxes can vary.

Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. Your 1099 tax form will be mailed to you if you dont receive an email from Stripe or dont consent to e-delivery. There are a few different taxes involved when you place an order.

Register your Instacart payment card. Instacart sends its independent contractors Form 1099-NEC. Instacart shoppers use a preloaded payment card when they check out with a customers order.

All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year. You will get an Instacart 1099 if you earn more than 600 in a year. What forms do I need to file taxes if I work Instacart.

Posted by 2 years ago. It shows your total earnings plus how much of your owed tax has already been. A simple tax return is Form 1040.

As for how you combine 1099 with W-2 income the 1099 income goes on line 1 of your Schedule C. Once Instacart Files your correction you will be notified via email and you will see a new 1099 tax form appear in the Stripe Express dashboard. Part-time employees sign an offer letter and W-4 tax form.

Currently the Instacart Shopper. When you work for instacart youll get a 1099 tax form by the end of january. Youll need to create an account and agree to e-delivery ie agree to receive your 1099 tax form electronically via Stripe Express to preview and download your 1099 tax form.

Guide To 1099 Tax Forms For Instacart Shoppers Stripe Help Support If you are a full-service Instacart shopper know that you are not an employee of the company and you are. You can also download the W2. Independent contractors have to sign a contractor agreement and W-9 tax form.

If youre an in-store only shopper you should receive a W2 form based on your address on file. Getting Your Instacart Tax Forms. To actually file your Instacart taxes youll need the right tax form.

Its pretty simple to file these yourself or you can pay someone to prepare them for you. The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively. Blank 1099 forms and the related instructions can be downloaded from the IRS website.

Instacart is an American company that operates a grocery delivery and pick-up service in the United. Sent to full or part-time employees. The sales tax may be applied to some or all of the items in your order in accordance with local laws depending on.

IRS deadline to file taxes. Your 1099 tax form will be available to download via Stripe Express.

What You Need To Know About Instacart 1099 Taxes

Instacart Pay How Much Does Instacart Pay Shoppers In 2022 Grocery Delivery

Instacart 1 Year Membership Costco

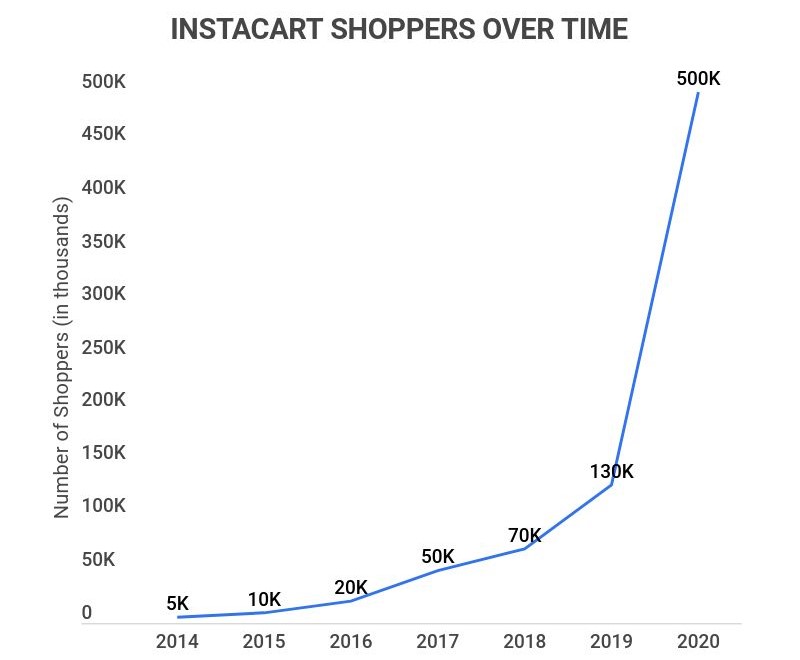

Instacart Statistics 2022 Users Revenue Growth And Grocery Ecommerce Market Trends Zippia

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Postmates 1099 Taxes And Write Offs Stride Blog

All You Need To Know About Instacart 1099 Taxes

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Am I Individual Or Sole Proprietor For Payable 1099 Doordash Instacart

Become An Instacart Shopper In 2022 The Full Application Process Ridesharing Driver

Everything You Need To Know About Publix Delivery Powered By Instacart Publix Super Market The Publix Checkout

Become An Instacart Shopper In 2022 The Full Application Process Ridesharing Driver

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

Is This Legit I M New To Instacart R Instacartshoppers

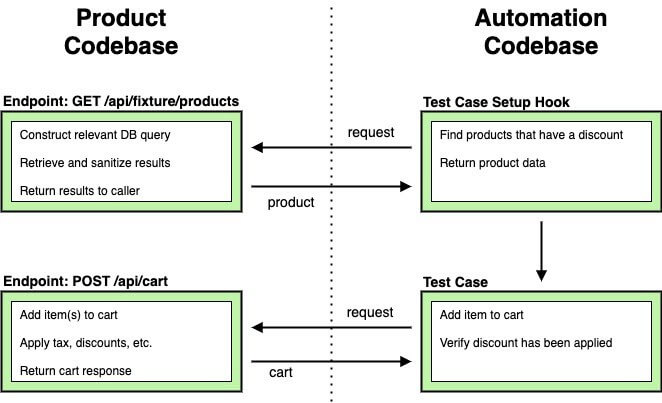

Understanding Software Quality At Scale

Why Is Grubhub Changing To 1099 Nec Entrecourier

Guide To 1099 Tax Forms For Instacart Shopper Stripe Help Support

I Was An Instacart Shopper I Had Enough When Someone Gave Me A 1 Star Review For Too Ripe Bananas Mother Jones